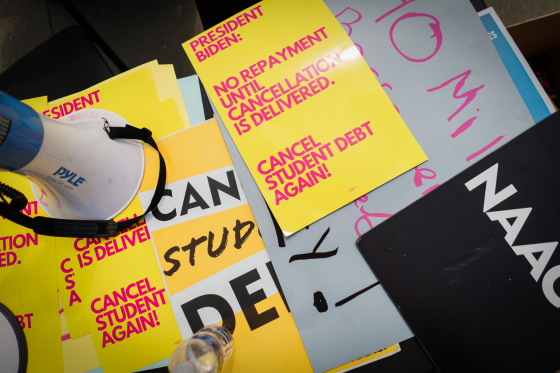

Two significant efforts to provide student loan forgiveness have been canceled by the Biden administration.

The secretary of the U.S. Department of Education would have been able to cancel student loans for a number of borrowers under the proposed regulations, including those who had been making payments for decades and others who were having financial difficulties.

Millions of Americans’ student loan debt might have been lowered or removed as a result of the combined actions.

Weeks before President-elect Donald Trump takes office, the Education Department announced its plans to remove them in notifications published in the Federal Register on Friday.

Due to operational difficulties in putting the suggestions into practice, the department announced in writing that it was ending the rulemaking process. In these last weeks of the government, it promised to dedicate its meager operational resources to assisting at-risk borrowers in making a successful payments return.

A request for comment was not immediately answered by the Education Department.

According to higher education expert Mark Kantrowitz, the Biden administration was aware that the Trump administration would have blocked the plans for widespread student loan forgiveness.

Trump is a strong opponent of student loan forgiveness; during the campaign, he referred to President Joe Biden’s efforts as “vile” and “illegal.”

Biden s latest plans became known as a kind of Plan B after theSupreme Court in June 2023struck downhis first major effort to clear people s student loans.

Consumer advocates voiced their displeasure and worries about the debt relief reversal.

President Biden s proposals would have freed millions from the crushing weight of the student debt crisis and unlocked economic mobility for millions more workers and families, Persis Yu, deputy executive director and managing counsel of the Student Borrower Protection Center, said in a statement.

Student loan forgiveness still available

“A lot of borrowers are worried about how the new administration will affect their student loans,” said Elaine Rubin, head of corporate communications at Edvisors, a company that assists students in managing their borrowing and educational expenses.

Experts noted that the Education Department continues to provide a variety of student loan forgiveness programs, such as Teacher Loan Forgiveness and Public Service Loan Forgiveness.

After ten years of timely payments, PSLF permits some government and non-profit employees to have their federal student loans forgiven. Under TLF, those who teach full-time for five consecutive academic years in a low-income school or educational service agency can be eligible for loan forgiveness of up to $17,500.

The Biden administrationannouncedFriday that it would forgive another $4.28 billion instudent loan debtfor 54,900 borrowers who work in public service through PSLF.

Many borrowers are particularly concerned about the future of the PSLF program, which is written into law, Rubin said. It would need a congressional act to be eliminated.

AtStudentaid.gov, borrowers can search for more federal relief options that remain available.

Meanwhile, The Institute of Student Loan Advisors hasa databaseofstudent loan forgiveness programs by state.

More from CNBC:

-

Honda and Nissan officially begin merger talks to create world s third-largest automaker

-

13 anonymous media executives make predictions for the new year

-

Lego is reinventing its iconic brick sets and keeping the toy industry afloat

Note: Every piece of content is rigorously reviewed by our team of experienced writers and editors to ensure its accuracy. Our writers use credible sources and adhere to strict fact-checking protocols to verify all claims and data before publication. If an error is identified, we promptly correct it and strive for transparency in all updates, feel free to reach out to us via email. We appreciate your trust and support!