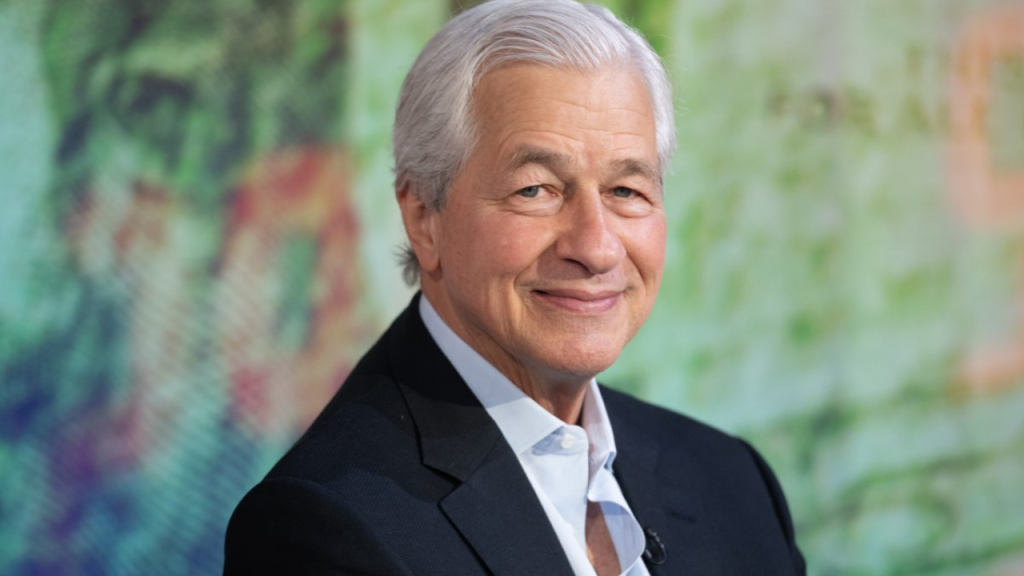

Jamie Dimon, CEO of JPMorgan Chase, is calling for a significant expansion of the earned income tax credit (EITC), proposing that the government nearly double the benefit and extend eligibility to include more low-income workers, particularly those without children.

Why It Matters?

The EITC, first introduced in 1975, is a refundable tax credit aimed at helping low- to moderate-income earners. Unlike tax deductions, it directly reduces the amount of taxes owed and can even lead to a refund if a person owes no income tax at all.

Currently, the maximum EITC benefit is $7,830 for a working parent with three or more children, while workers without children can receive up to just $600. Dimon argues that increasing the credit would provide critical financial support to families struggling in today’s uncertain economic climate.

Dimon’s Proposal

In an interview with Fox Business host Maria Bartiromo, Dimon shared the example of a single mother earning $12,000 a year. “The government gives you $6,000,” he said of the current credit. “I would almost double it.

I’d get rid of the child requirement. I’d get more money into the hands of the lower-paid. I think it’s very important. It creates jobs, creates dignity, and better households.”

Dimon emphasized that such a change would not only support families but also boost the overall economy. “It brings people into the workforce,” he said. “They’ll probably drive the GDP… It’s a small price to pay.”

Back in January, at a Bipartisan Policy Center panel, Dimon called the expansion of the EITC “a no brainer” and suggested funding it by “taxing the wealthy a little bit more.”

Current Landscape and Reactions

Each year, the EITC delivers around $60 billion to working families. Some political figures, like former House Speaker Paul Ryan, have proposed reforms such as simplifying eligibility and distributing the credit throughout the year rather than in a single annual payment.

While many applaud Dimon’s focus on supporting low-income workers, others question the motives behind corporate advocacy for government solutions.

Kevin Thompson, CEO of 9i Capital Group, told Newsweek, “It’s curious how CEOs are quick to recommend tax credits instead of simply raising wages. They want workers to earn more, but not from their bottom line—instead, they look to the government to pick up the slack.”

He added that expanding tax credits could worsen the national debt. “If we’re truly worried about the deficit, increasing tax credits is the last thing we should be doing. It’s more spending without solving the core issue: corporate responsibility in fair compensation.”

Alex Beene, a financial literacy instructor at the University of Tennessee at Martin, offered a more sympathetic take, noting that many families are currently feeling the pressure of rising costs. “Between inflation and tariffs, the cost of living is rising fast,” Beene said.

“Doubling the EITC could help ease some of the financial burdens these families are facing now and likely will shortly.”

What’s Next?

Dimon’s proposal comes ahead of a key moment in tax policy, as several provisions from the 2017 tax reform law are set to expire in 2025.

Whether lawmakers will act on his suggestion remains uncertain, but Dimon has certainly added a powerful voice to the ongoing conversation around one of America’s most effective anti-poverty programs.

Still, concerns about the national debt loom large. “Any tax cut, especially while running massive deficits, is essentially borrowing from the future,” Thompson warned.

“If the funding doesn’t come from current tax revenue, it’ll come from borrowing—and that means future generations will pay through higher taxes, reduced services, or inflation.”