Borrowers who have fallen behind on their federal student loan debt will experience collection action this year, including the garnishment of their paychecks and retirement benefits, for the first time in around five years.

For the first time, a top official in a new U.S. Department of Education memo that CNBC was able to get outlines when garnishments may resume in certain situations, possibly as early as this summer.

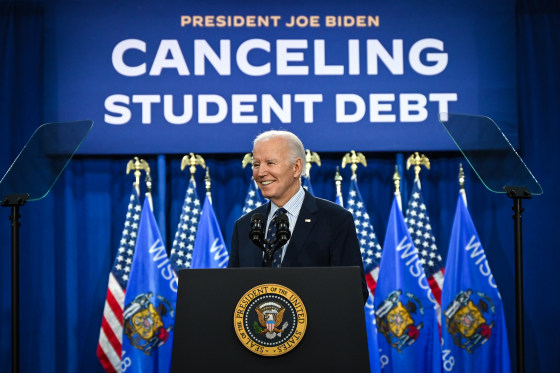

Days before the Trump administration assumes power, the letter outlines the actions the Biden administration has taken to prevent a federal student loan default problem. As collection efforts pick back up this year, it provides the department with measures to help student loan borrowers stay current.

Since the Department intends to resume default fines and forced collections later this year, it is imperative that the objectives and actions described in this memo be carried out in full. In the message, U.S. Undersecretary of Education James Kvaal addresses Federal Student Aid’s acting chief operating officer, Denise Carter.

According to the Education Department, around 7.5 million federal student loan borrowers were in default in 2022. This sobering statistic has prompted analogies to the mortgage crisis of 2008.

Borrowers could face Social Security offsets by August

The Biden administration provided debtors with a 12-month on-ramp to repayment when the Covid-era suspension of federal student loan installments ended in September 2023. They were protected from the majority of the repercussions of falling behind on their payments at that time. On September 30, 2024, the relief period came to an end.

According to the Education Department, starting in October of this year, federal student loan borrowers who are in arrears may have their salaries garnished. In the meanwhile, offsets for Social Security benefits can start up again as early as August.

The Federal Student Aid office of the Department of Education is instructed in the memo to carry on the efforts of the Biden administration to prevent defaults.

Allowing borrowers to give the department permission to collect their income data from the IRS and automatically enrolling borrowers in an income-driven repayment plan in the event that they fall 75 days behind on their loans are two examples of how to make it simpler for borrowers to sign up for affordable repayment plans. IDR plans determine a borrower’s monthly payment based on their family size and discretionary income; some are left with a cost of zero per month. After a predetermined amount of time, usually 20 or 25 years, any outstanding debt is cancelled.)

According to the paper, before borrowers legally default, they should also be checked for other forgiveness options.

In order to persuade borrowers to enroll in automatic payments to their student loan servicer, the document also urges the Education Department to look at ways to increase the present interest rate incentive. Currently, borrowers can usually lower their interest rate by 0.25 percentage points by doing this.

Reduced penalties for student loan defaults

According to the memo, debtors in default will have a path to forgiveness and be eligible to sign up for the Income-Based Repayment Plan for the first time later this year. Currently, in order to participate in any of the income-driven repayment plans, such as the IBR, borrowers of federal student loans must first exit default.

The memo claims that the majority of federal student loan collection fees have been removed by the Biden administration.

It also took action to safeguard more people’s Social Security benefits from the department’s collecting capabilities at the beginning of 2024. In contrast to the existing protected threshold of $750, individuals who receive a monthly Social Security benefit of less than $1,883 can shield their benefits from offset when the effects of defaults reappear.

According to the memo, the data now available indicates that these measures will successfully stop Social Security offsets for over half of the impacted borrowers and lower the offset amount for many others.

More from CNBC:

-

TikTok s U.S. operations could be worth as much as $50 billion if ByteDance decides to sell

-

FTC sues Deere, alleging equipment repair monopoly raises costs for farmers

-

Quantum computing stocks rip higher on Microsoft s quantum-ready directive