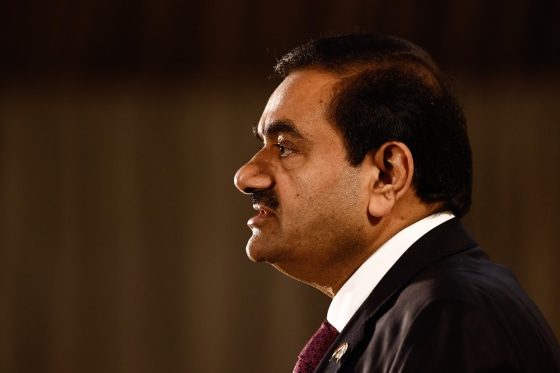

The second-richest person in India, Gautam Adani, has been charged by U.S. authorities with fraud after it was alleged that he and a number of suspected co-conspirators attempted to bribe Indian officials $250 million.

The executives, the majority of whom are Indian, were charged by the U.S. attorney’s office in Brooklyn, New York, on Wednesday with obtaining money from U.S. investors and other foreign lenders by making false and deceptive claims. Authorities also claim that the executives bribed Indian officials in order to secure billions of dollars in solar power contracts.

In a statement released with the indictment, U.S. Attorney Breon Peace claimed that the defendants had planned a complex plot to bribe Indian government officials in order to obtain contracts valued at billions of dollars. The defendants subsequently attempted to obtain money from foreign and American investors by lying about the bribery plot, according to Peace.

Prosecutors said the scam took place between 2020 and this year.

Adani’s nephew, Sagar Adani, is also included as a defendant. Charges of civil fraud were separately announced by the Securities and Exchange Commission on Wednesday.

According to Forbes, Gautam Adani, 62, is worth over $70 billion. He is the head of the Adani Group, an industrial conglomerate that owns shares in energy and logistics companies. The accusation, which refers to an unidentified Indian renewable energy company that was a portfolio company of an Indian conglomerate, does not name the Adani Group directly.

Meanwhile, Adani Green Energy Ltd., a division of the Adani Group, is specifically named in the SEC lawsuit.

Adani Group refuted the claims in a statement released on Thursday, claiming they were unfounded.

A spokeswoman stated in a statement that the Adani Group has always upheld and is resolutely dedicated to upholding the highest standards of governance, transparency, and regulatory compliance across all jurisdictions of its activities. We reassure our partners, stakeholders, and staff that we are a law-abiding company that complies with all applicable laws.

According to CNBC, the announcement caused shares of Adani Group companies to plummet in India on Thursday. Adani Energy had a 20% decline, while its flagship Adani Enterprises saw a 23% decline. The business at the heart of the bribery accusations, Adani Green Energy, saw an 18.95% decline.

Plans to offer $600 million in bonds denominated in US dollars were also halted by Adani Green Energy.

The opposition party in India has accused Adani of taking advantage of his close relationship with Indian Prime Minister Narendra Modi.

Rahul Gandhi, the head of the Indian National Congress, stated on Thursday that he is aware that no government agency will assist in placing Mr. Adani in his proper place. We are aware of this as the prime minister controls the entire government.

Using claimed inconsistencies in its official records, a well-known U.S. short-seller—a corporation that wagers on the price of another company’s shares to drop—accused Adani Group of fraud last year.

Adani Group shares fell after the conclusions of the short-seller Hindenburg Research, but they eventually rose after the Indian Supreme Court issued a positive decision regarding the claims.

Modi never addressed the Hindenburg accusations in public.

We have maintained our position that Adani is the biggest corporate scam in history ever since we published our research in January 2023. “Neither has Adani ever denied our findings,” Hindenburg stated in a statement sent by email on Wednesday.

Note: Thank you for visiting our website! We strive to keep you informed with the latest updates based on expected timelines, although please note that we are not affiliated with any official bodies. Our team is committed to ensuring accuracy and transparency in our reporting, verifying all information before publication. We aim to bring you reliable news, and if you have any questions or concerns about our content, feel free to reach out to us via email. We appreciate your trust and support!