Michael MacGillivray, 25, wanted his investments to reflect his perception of artificial intelligence becoming more pervasive in daily life. He quickly figured out how he intended to capitalize on the trend.

“Every path leads to Nvidia when you look at AI,” said MacGillivray, who has invested hundreds of dollars in shares this year from his Michigan home. Without a doubt, it was a wise investment.

According to statistics from Vanda Research, MacGillivray’s acquisitions have helped explain why average investors have invested close to $30 billion in Nvidia this year. As of December 17, it is the equity that retail traders have purchased the most of on the net in 2024.

More from CNBC

-

Biggest banks sue the Federal Reserve over annual stress tests

-

Here s why business leaders are spending big on Trump s inaugural committee

-

FDA says the Zepbound shortage is over. Here s what that means for patients who used off-brand versions.

-

These 4 Americans moved abroad and don t plan on coming back anytime soon: I m happier here

Compared to the SPDR S&P 500 ETF Trust (SPY), which monitors the broad benchmark for the U.S. stock market, Nvidia has experienced nearly twice as many net inflows from this group. Additionally, it is poised to overtake Tesla, the preferred option for retail investors that won the most-bought distinction in 2023.(The company subtracts the total outflows from the total inflows for each security to determine the net flows.)

According to Marco Iachini, senior vice president at Vanda, Nvidia was the stock that sort of stole the show from Tesla due to its remarkable price increases. The performance is self-evident.

Up and up and up

It’s Nvidia’s newest feather in the cap. For almost a year, investors of all sizes have been captivated by the AI giant. The chipmaker is by far the best-performing 30-stock index of 2024 and was admitted to the prestigious Dow Jones Industrial Average last month.

Even though December trading was difficult, the Magnificent Sevenstock is expected to end 2024 more than 180% higher. Due to this spike, the stock is now part of an exclusive group of corporations with market capitalizations above $3 trillion. Additionally, Nvidia is now the second-most valued corporation in the United States.

Naturally, this push into Nvidia shares has resulted in the stock playing a larger role in the average investor s holdings. According to Vanda data, Nvidia’s weight in the average mom-and-pop trader’s portfolio has increased from 5.5% at the beginning of 2024 to over 10% now. It currently ranks only behind Tesla as the second-largest asset for the typical retail investor.

Furthermore, compared to just three years ago, Nvidia’s net retail inflows in 2024 are more than 885% higher.

Gil Luria, head of technology research at investment bank D.A. Davidson, said that Nvidia “stands out in terms of how quickly retail investors became such a big part of the ownership stake.” It was an impressive climb.

Social media marketer Genevieve Khoury is one of those individual investors. She first began buying shares in 2022 at the recommendation of her dad, who works in the technology sector. Khoury plans to sit on her shares until she can cash in the nest egg for a down payment on a home or other significant purchase.

It kept going up and up and up, said the Los Angeles-area resident. I m just holding it.

Jaw dropping

Inflows tended to spike this year around Nvidia s earnings reports, according to Vanda s Iachini. Retail investors also bought in during an early August dip, which coincided with abroader market sell-off.

To be sure, the stock has seen inflows cool to an extent as it lost some steam. D.A. Davidson s Luria noted that shares were more expensive six months ago than in recent sessions.

Even as Nvidia continued beating Wall Street expectations for earnings, it wasn t exceeding estimates by enough to continue the stock s rapid price growth, Luria said. Now, he said the stock has come to more balanced and reasonable levels.

Despite this recent volatility, individual investors such as Prajeet Tripathy remain optimistic over the company s leadership within AI and focus on innovation. I think that it s only going to keep rising exponentially, said Tripathy, a recent college graduate.

Though investing is largely a digital activity, market participants love for Nvidia has spilled into the real world. Several gathered in New York City in late August for awell-documentedwatch party centered around Nvidia s earnings report. This event came within months of the stock s10-to-1split, a move that s typically done to incentivize retail investors.

While Nvidia s retail ownership is substantial, this factor hasn t pushed the price-to-earnings multiple higher in the same way that it has for Tesla andPalantir, Luria said. Still, Morningstar equity strategist Brian Colello said Nvidia has fairly significant volatility for a stock of its size, which can underscore the role retail traders can play in driving share prices.

It s jaw dropping at times that such a large company can have such a big move in the stock price on any given day, Colello said.

What retail investors want next

2024 marks the second straight year that a single stock has eclipsed the SPDR S&P 500 ETF Trust in net flows. However, sizable inflows to the ETF can assuage any concerns that investors are forgoing broad index funds deemed safe investments, according to Iachini. The past two years of high inflows into megcap tech names can instead reflect traders chasing theongoing bull market, Iachini said.

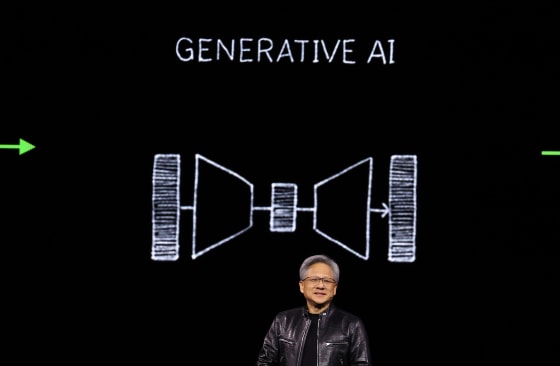

Notwithstanding strong returns, Iachini said, Nvidia can be a surprising pick for the typical at-home investor. Despite Nvidia CEO Jensen Huang s signature leather jacket, the company lacks a God-like personality that can garner retail investor attention, Iachini said. For an example, he pointed to Tesla CEO Elon Musk, who made waves this year for hispublic backingof President-elect Donald Trump during the campaign.

Looking ahead, Palantir has gained traction among the retail crowd during the fourth quarter and could be a favorite in the new year, Iachini said. The software stock has been the ninth most-bought security on balance in 2024, beatingAmazon, Alphabet and Microsoft, per Vanda data.

Palantir CEO Alex Karpthanked small-scale investorsduring a video posted Sunday that was set against a snow-covered backdrop. Exceedingly grateful to all of you individual investors who took the time and opportunity, and had the courage to look past conventional, rusty, crusty platitudes, Karp said in the clip, while sporting reflective goggles and gripping ski poles.

Fittingly enough, Palantir was one recent pickup from Khoury, the social media marketer in California, on a friend s advice. Khoury is hopeful for a Nvidia-like run, so she can retain bragging rights with acquaintances who believe they know more about investing than her. It s going well so far: The stock has skyrocketed close to 380% in 2024, making it the best performer in theS&P 500year-to-date.

Multiple times in college, people would try and talk to me about it like I didn t know what I was talking about, said Khoury, who graduated this year with a degree in finance. I m like, sure, yeah, I don t know what I m talking about, but I do have Nvidia.

Probably, she said, my portfolio looks better than yours.

Note: Every piece of content is rigorously reviewed by our team of experienced writers and editors to ensure its accuracy. Our writers use credible sources and adhere to strict fact-checking protocols to verify all claims and data before publication. If an error is identified, we promptly correct it and strive for transparency in all updates, feel free to reach out to us via email. We appreciate your trust and support!