According to two lawsuits filed Wednesday by a housing nonprofit organization in Indianapolis, two sizable private-equity-backed landlords discriminated against potential renters by utilizing screening systems that provided false information about applicants’ prior evictions and criminal records. Tenants and their activists filed the claims in response to complaints about the negative effects that certain private equity-backed landlords have had on locals, such as frequent evictions, reduced property maintenance, and garbage fees.

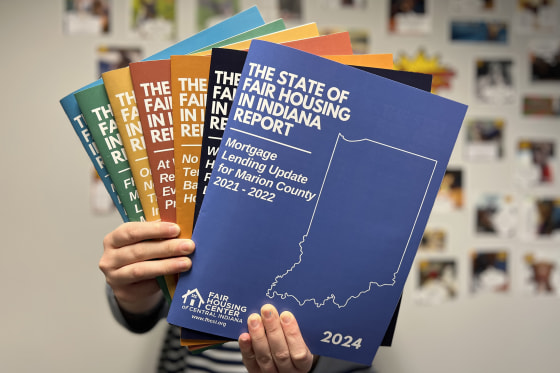

The new lawsuit focuses on two landlords: Progress Residential, owned by Pretium Partners, which is managed by former Goldman Sachs executive Don Mullen, and Tricon Residential, a California-based landlord recently purchased by the Blackstone Group of New York City, one of the nation’s more prominent private equity firms. The Fair Housing Center of Central Indiana, an advocacy organization that serves citizens in 24 counties around the state, filed the lawsuits. According to the cases, Tricon and Progress both rejected tenant applications on the basis of false information provided by a third-party screening agency, and neither landlord checked the information.

Because Black persons are more likely to be evicted and to be stopped by law enforcement, arrested, convicted, and imprisoned at the federal, state, and municipal levels, the cases claim that relying on such information is a form of racial discrimination. The claims claim that categorical restrictions regarding criminal history and evictions hurt otherwise qualified Black applicants.

People are having difficulty finding new housing because of our extremely low vacancy rates, growing housing costs, and stagnant salaries, according to Amy Nelson, executive director of the Fair Housing Center. We’ve been doing a lot of outreach to spread the news about screening-based obstacles for tenants since any kind of barrier can be disastrous.

In a statement, a representative for Tricon Residential stated: Tricon complies with all Fair Housing regulations and considers the accusations in this lawsuit to be unfounded. A Blackstone representative declined to comment, but the lawsuit’s details took place prior to Blackstone’s acquisition of the business.

“As a premier professional property manager, we are dedicated to promoting a fair and equitable screening process for all applicants,” said a Progress Residential spokesperson. We take these allegations seriously and are currently examining the lawsuit’s claims, even though we do not comment on ongoing litigation.

A 2019 study by the National Consumer Law Center, a nonprofit that supports low-income individuals, found that the great majority of landlords demand applicants to submit to third-party background checks. However, campaigners claim that erroneous information in background checks might create unjust obstacles for tenants.

Large tracts of housing have been acquired by private equity-backed landlords in recent years, including apartment complexes and single-family houses. According to research, these purchases have reduced the number of reasonably priced starter homes available in many neighborhoods. According to the cases, Tricon and Progress together control at least 130,000 single-family houses across the nation.

According to the Indiana complaints, Tricon and Progress both prohibit renters with criminal records. According to one lawsuit, Progress rejects applicants who have been convicted of a crime within the last ten years, as well as certain felonies, regardless of when they occurred, and certain misdemeanors within the last three years. According to the other lawsuit, Tricon will not rent to applicants who have been convicted of a felony within the last seven years or who have been convicted of any other violation, regardless of when they occurred. Additionally, renters who have been evicted in the last two years are prohibited from Tricon.

Additionally, tenant screening procedures may be discriminatory, according to federal prosecutors. According to a civil lawsuit filed last month in the Eastern District of Missouri, Kinloch apartment complex landlords discriminated against potential Black renters by barring tenants with specific criminal histories from late 2015 until January 2024. According to the lawsuit, such criminal histories are known to exhibit notable statistical racial discrepancies. It also stated that the records taken into consideration by the landlords are not credible indicators of future criminal conduct or accurate proxies for the real underlying criminal activity. An email request for response from the housing complex was not answered.

Marckus Williams, the plaintiff in both cases brought by the nonprofit organization in Indiana, told NBC News that he attempted to rent houses from both Tricon and Progress in November 2022 but was denied. Although Williams’ convictions for cocaine possession in 2006 and 2012 had been expunged, both landlords rejected him because they showed up on his tenant screening reports.

In a phone conversation, Williams said, “I sent them my expungement records, but I kept getting denied.” It causes you to feel self-conscious. Give me a chance, please.

After a number of big supermarkets left an area of Indianapolis that had turned into a food desert, Williams, a former electrician, founded a grocery store there. Although the store has grown and is now a success, he had trouble finding housing in the beginning. He lived in his car for approximately a month over the 2022 Christmas holidays.

According to Williams, that was truly upsetting for him. There should always be opportunities for second chances.

Williams’ claims come after federal agencies, such as the Consumer Financial Protection Bureau and the Federal Trade Commission, increased their scrutiny of tenant screening programs. For instance, the FTC filed a lawsuit against TransUnion, a credit reporting company, in October 2023, claiming that the company had neglected to verify the veracity of eviction data in tenant screening reports it gave to landlords. The FTC claimed that it had violated the Fair Credit Reporting Act by including false information in its reports. According to the FTC, TransUnion paid $15 million, the highest sum ever collected in a tenant screening case, and settled the lawsuit without acknowledging or disputing the claims.

A clause prohibiting the inclusion of sealed eviction records, unresolved eviction cases, and numerous filings for a single eviction case was part of the proposed order in the TransUnion case. According to the Fair Housing Center, such filings were found on the rental screening reports Tricon employed and led to automatic denials for applications from Indiana.

According to Nelson, executive director of the center, it might be challenging for people to recognize that they were the target of discrimination. Fair housing rules are meant to create safe communities where people can establish their lives and contribute.

Note: Thank you for visiting our website! We strive to keep you informed with the latest updates based on expected timelines, although please note that we are not affiliated with any official bodies. Our team is committed to ensuring accuracy and transparency in our reporting, verifying all information before publication. We aim to bring you reliable news, and if you have any questions or concerns about our content, feel free to reach out to us via email. We appreciate your trust and support!