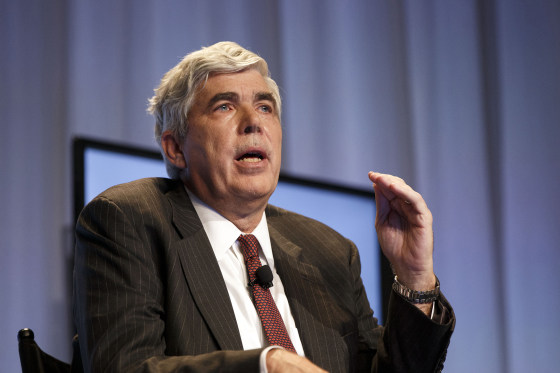

U.S. officials charged former Western Asset Management Co. co-chief investment officer Kenneth Leech on Monday with engaging in a fraudulent cherry-picking scheme in which he unfairly gave preference to certain client accounts over others when allocating trades.

Between January 2021 and October 2023, Leech disproportionately assigned better-performing trades to favored portfolios and worse-performing trades to other portfolios, according to the U.S. Securities and Exchange Commission.

According to the SEC, Leech is also facing related criminal allegations from the Manhattan office of the U.S. Attorney.

Requests for comment were not immediately answered by Leech’s attorneys. A comparable request was not quickly answered by the U.S. attorney’s office.

Wamco, also known as Western Asset Management, is a division of Franklin Resources, which purchased the company in 2020 when it bought Legg Mason.

Following Franklin’s announcement that authorities were looking into Leech, Wamco has seen tens of billions of dollars in withdrawals from customers in recent months.

Note: Every piece of content is rigorously reviewed by our team of experienced writers and editors to ensure its accuracy. Our writers use credible sources and adhere to strict fact-checking protocols to verify all claims and data before publication. If an error is identified, we promptly correct it and strive for transparency in all updates, feel free to reach out to us via email. We appreciate your trust and support!